Chapters

How Blockchain Is Changing Financial Systems: Revolutionizing Traditional Finance for a Decentralized Future

Overview

Introduction: How Blockchain Is Changing Financial

Systems

The advent of blockchain technology has been nothing

short of revolutionary, disrupting industries across the globe. In particular, financial

systems are undergoing profound changes as blockchain offers a

decentralized alternative to traditional banking and finance methods. While

initially associated with cryptocurrencies like Bitcoin,

blockchain’s applications extend far beyond digital currencies. Today, it is at

the heart of an evolving financial ecosystem that promises to enhance transparency,

security, efficiency, and inclusivity within financial

transactions and services.

This chapter explores how blockchain technology is

reshaping the traditional financial system, focusing on its key applications in

banking, payments, lending, asset management, and insurance.

We will also examine the impact of decentralized finance (DeFi), smart

contracts, and digital currencies on financial institutions and

their customers. With blockchain’s ability to facilitate secure, peer-to-peer

transactions without intermediaries, we are witnessing a fundamental shift

toward more transparent, efficient, and equitable

financial services.

Blockchain is more than just a buzzword—it is laying the

foundation for the future of finance. From cross-border payments

to smart contracts in asset management, blockchain promises to

remove barriers that have historically restricted access to financial services

for large parts of the global population. But the transition isn’t without its

challenges. The road to widespread adoption involves overcoming regulatory

hurdles, technological barriers, and social perceptions about trust in digital

currencies and decentralized platforms.

In this comprehensive guide, we will dive into the core

aspects of blockchain’s impact on finance and explore how it is creating

a more open, inclusive, and efficient global financial

system.

Blockchain’s Role in Revolutionizing Financial Systems

- The

Decentralization of Finance

Traditional financial systems are built on centralized networks controlled by institutions such as banks, government entities, and payment processors. Blockchain disrupts this centralized model by introducing a decentralized approach where peer-to-peer (P2P) transactions occur without the need for intermediaries. This fundamentally alters how money, assets, and data are transferred, stored, and verified across networks. - Financial

Inclusion

One of the most significant benefits blockchain brings to the financial landscape is its potential to foster financial inclusion. In many parts of the world, a large percentage of the population lacks access to basic financial services due to issues like geographical location, low literacy, or lack of infrastructure. With blockchain-based cryptocurrency systems like Bitcoin or Ethereum, individuals can engage in financial transactions without needing a traditional bank account, giving them a new route to access financial services. - Enhancing

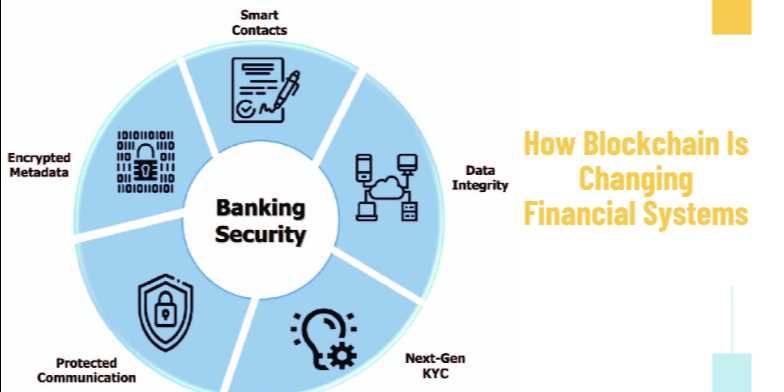

Security and Transparency

Blockchain technology enhances security by providing a distributed ledger where each transaction is recorded in a public, immutable database. This makes it almost impossible for fraudulent activities to occur. The transparency of blockchain also ensures that all parties can track and verify the authenticity of financial transactions. This offers enormous potential for reducing fraud, especially in cross-border transactions and remittance services. - Smart

Contracts: Automating Transactions

One of the most exciting aspects of blockchain technology is the introduction of smart contracts—self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute when predefined conditions are met. Smart contracts eliminate the need for intermediaries, significantly reducing costs and time spent on paperwork. Their use is revolutionizing industries like real estate, insurance, and loans, enabling more efficient and secure transactions. - Decentralized

Finance (DeFi)

Decentralized Finance (DeFi) is one of the most important developments in blockchain technology’s impact on financial systems. DeFi refers to the use of blockchain-based systems to recreate traditional financial products such as lending, borrowing, trading, savings, and insurance in a decentralized way, without intermediaries like banks. By leveraging smart contracts and blockchain’s transparent nature, DeFi platforms offer greater financial accessibility and autonomy for users, while also democratizing the financial system by providing services to the unbanked. - Blockchain

in Payments and Remittances

Cross-border payments and remittance services have been a traditional stronghold of banks and financial institutions, but blockchain is challenging this paradigm. Cryptocurrencies and blockchain-powered payment networks like Ripple (XRP) offer faster, cheaper, and more secure methods for transferring funds across borders. With blockchain, transactions can be settled in minutes or seconds, compared to days with traditional methods, and at a fraction of the cost. Blockchain-based payment systems allow businesses and individuals to send money across the world without worrying about fees or currency conversions. - Tokenization

of Assets

Another significant innovation is tokenization, where physical or digital assets are represented as tokens on a blockchain. These tokens can represent anything from real estate to stocks, bonds, or even artworks. By converting assets into tradable tokens, blockchain enables easier ownership transfer, liquidity, and fractional ownership. For example, a piece of artwork that costs millions can be tokenized and sold in smaller, more affordable fractions to a larger pool of buyers. This innovation democratizes access to high-value assets and opens new markets for retail investors. - Blockchain

and Cryptocurrencies in Banking

Blockchain’s integration into banking goes beyond just cryptocurrency transactions. Banks are increasingly exploring blockchain technology to streamline their internal processes, such as settlement systems, trade clearing, and cross-border payments. Furthermore, blockchain can help reduce fraud and provide enhanced auditability, as all transactions are logged in a secure, immutable ledger. Central banks are also exploring the concept of Central Bank Digital Currencies (CBDCs), which are digital versions of fiat currencies that could be issued and regulated by the central bank, offering a controlled entry point into the digital currency world.

The Challenges and Future of Blockchain in Finance

Despite the many advantages blockchain offers, its full

potential in the financial sector is still being realized. Some challenges

remain that need to be addressed for widespread adoption.

- Regulatory

Challenges

As blockchain and cryptocurrency disrupt traditional finance, regulators face the challenge of creating clear rules around digital currencies, financial transactions, and decentralized finance. Many governments are still figuring out how to classify cryptocurrencies and whether to impose taxes or regulate them. Regulatory uncertainty can slow down blockchain innovation and adoption in the financial sector, as businesses and investors may hesitate to commit until clear guidelines are in place. - Scalability

Issues

While blockchain has the potential to revolutionize finance, scalability remains a significant challenge. Many blockchain networks, such as Bitcoin, can handle only a limited number of transactions per second (TPS). As financial systems scale, more advanced solutions are needed to ensure that blockchains can handle large volumes of transactions efficiently. Solutions like sharding and Layer 2 scaling solutions are being developed to address this issue and enhance blockchain scalability. - Security

and Fraud Risks

Blockchain provides security and transparency, but it is not entirely immune to fraud. While transactions are immutable and verifiable, vulnerabilities still exist, especially when it comes to smart contract bugs or weak points in cryptographic algorithms. Additionally, cryptocurrency exchanges and wallets are common targets for hackers, posing risks to user funds. - Interoperability

The lack of interoperability between different blockchain networks remains another challenge. Many blockchain platforms operate in isolation, making it difficult to share information and assets across networks. For blockchain to be fully effective in transforming finance, interoperability standards must be developed, allowing different blockchain networks to communicate seamlessly.

Conclusion

Blockchain technology is fundamentally transforming the way financial

systems operate. With its ability to provide secure, transparent, and

efficient financial transactions, blockchain has the potential to democratize

finance by offering decentralized finance (DeFi), reducing fraud, and

making financial services more inclusive and efficient.

Innovations like smart contracts, cryptocurrencies, tokenization,

and cross-border payment systems are reshaping banking and finance as we

know it, while reducing the reliance on intermediaries.

However, to fully realize the potential of blockchain in the

financial sector, challenges like regulatory issues, scalability,

and security need to be addressed. The future of finance will likely be

marked by the integration of blockchain technology with traditional

financial systems, centralized banking solutions exploring digital

currencies, and the growing adoption of blockchain-based solutions

in everyday transactions.

Blockchain has already shown that it can change the way financial

markets operate. The next step will be to build a truly global and secure

decentralized financial ecosystem that serves the needs of businesses,

governments, and individuals around the world.

FAQs

1. How does blockchain disrupt traditional financial systems?

Blockchain eliminates the need for intermediaries by enabling decentralized, peer-to-peer transactions. This reduces transaction costs, enhances transparency, and increases financial accessibility for people who lack access to traditional banking.

2. What is decentralized finance (DeFi)?

DeFi refers to financial services like lending, borrowing, and trading that operate on blockchain networks, removing the need for centralized intermediaries like banks or financial institutions.

3. What is tokenization, and how does it change financial systems?

Tokenization refers to converting real-world assets like real estate, stocks, or art into digital tokens on the blockchain. This increases liquidity, fractional ownership, and market access for retail investors.

4. How do smart contracts work in financial transactions?

Smart contracts are self-executing contracts with terms coded directly into the blockchain. They automatically execute and verify the terms of an agreement without the need for intermediaries, improving efficiency and reducing costs.

5. What are the security benefits of blockchain in finance?

Blockchain provides enhanced security by recording transactions in an immutable ledger. This makes it difficult for fraudsters to manipulate or alter transaction data, offering more security than traditional banking systems.

6. What are the regulatory challenges for blockchain in finance?

Governments are still grappling with how to regulate cryptocurrencies and blockchain-based financial services. There is uncertainty about how to classify and tax digital assets, which can hinder blockchain adoption in finance.

7. What is the role of Central Bank Digital Currencies (CBDCs)?

CBDCs are digital currencies issued and regulated by central banks. They combine the benefits of blockchain technology with government oversight, offering a controlled yet efficient digital alternative to cash.

8. How does blockchain improve financial inclusion?

Blockchain allows individuals without access to traditional banking systems to engage in financial services using cryptocurrencies and decentralized applications. This enhances global financial inclusion and provides services to the unbanked.

Posted on 06 May 2025, this text provides information on Blockchain. Please note that while accuracy is prioritized, the data presented might not be entirely correct or up-to-date. This information is offered for general knowledge and informational purposes only, and should not be considered as a substitute for professional advice.

Comments(0)